Initiatives Toward TCFD Recommendations

In line with the Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), the Company carries out the establishment of governance structures, risk management, and goal setting, conducts scenario analyses, and deliberates on business strategies based on the results of those analyses. On this occasion, in addition to announcing its endorsement of the TCFD Recommendations, the Company joined the TCFD Consortium which was established as a forum for discussion for endorsing companies. For the realization of a carbon-free society, the Company will continue to strive for social contributions and the enhancement of corporate value by continuing with business activities that are considerate of the environment.

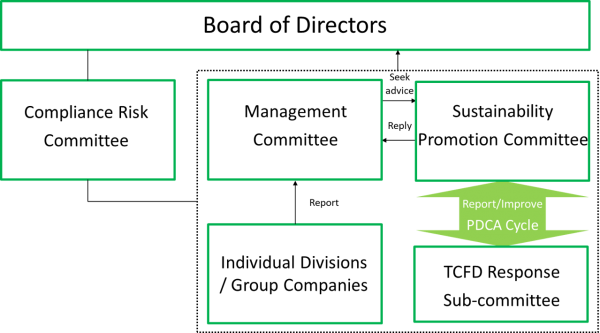

Governance Structure Concerning Climate Change

| Corporate Body | Role | Frequency* |

|---|---|---|

| Board of Directors | Supervision of climate change responses | Semiannually |

| Compliance Risk Committee | Response to climate change risk through company-wide risk management, establishment and maintenance of risk management systems | Semiannually |

| Management Committee (changed on June 1, 2022; previously Consolidated Management Committee) | Deliberation of basic policies and key matters related to climate change | Semiannually |

| Sustainability Promotion Committee | Recommendations of basic policies and key matters related to climate change and reports of activities as an advisory body of the Management Committee | Semiannually |

| TCFD Response Sub-committee | Identification of risks and opportunities related to climate change, analysis and evaluation of impacts, and consideration and reporting of response measures as a sub-committee of the Sustainability Promotion Committee | As necessary |

Governance

In light of the fact that the world is addressing the realization of a sustainable society and the growing demands on the Company by various stakeholders to address social and environmental issues, the Company positions sustainability issues as a key management challenge. In particular, the Company recognizes initiatives in response to climate change as an especially critical management challenge, and under the responsibility of the Sustainability Promotion Committee (Chair: Representative Director, President & CEO), an advisory body of the Management Committee, the TCFD Response Sub-committee identifies risks and opportunities related to climate change, analyzes and evaluates its impacts, and considers and reports on response measures. In addition, to enable appropriate supervision by the Board of Directors, the Sustainability Promotion Committee regularly (semiannually) reports to the Board of Directors on the state of activities, etc. after the Management Committee.

Risk Management

Business risks are identified by each division and Group company as part of company-wide risk management before being deliberated by the Management Committee. In particular, the impact of climate change is recognized as an especially critical business risk, and the TCFD Response Sub-committee, under the Sustainability Promotion Committee, which is an advisory body of the Management Committee, coordinates with the relevant divisions to identify risks and consider response measures. The matters identified or considered by the TCFD Response Sub-committee are reported to the Sustainability Promotion Committee and deliberated by the Management Committee. Matters deliberated by the Management Committee are reported to the Board of Directors, and the Board of Directors works together with the Compliance Risk Committee to observe the status of risks continuously, while monitoring the progress of response measures and managing and supervising company-wide risks in general.

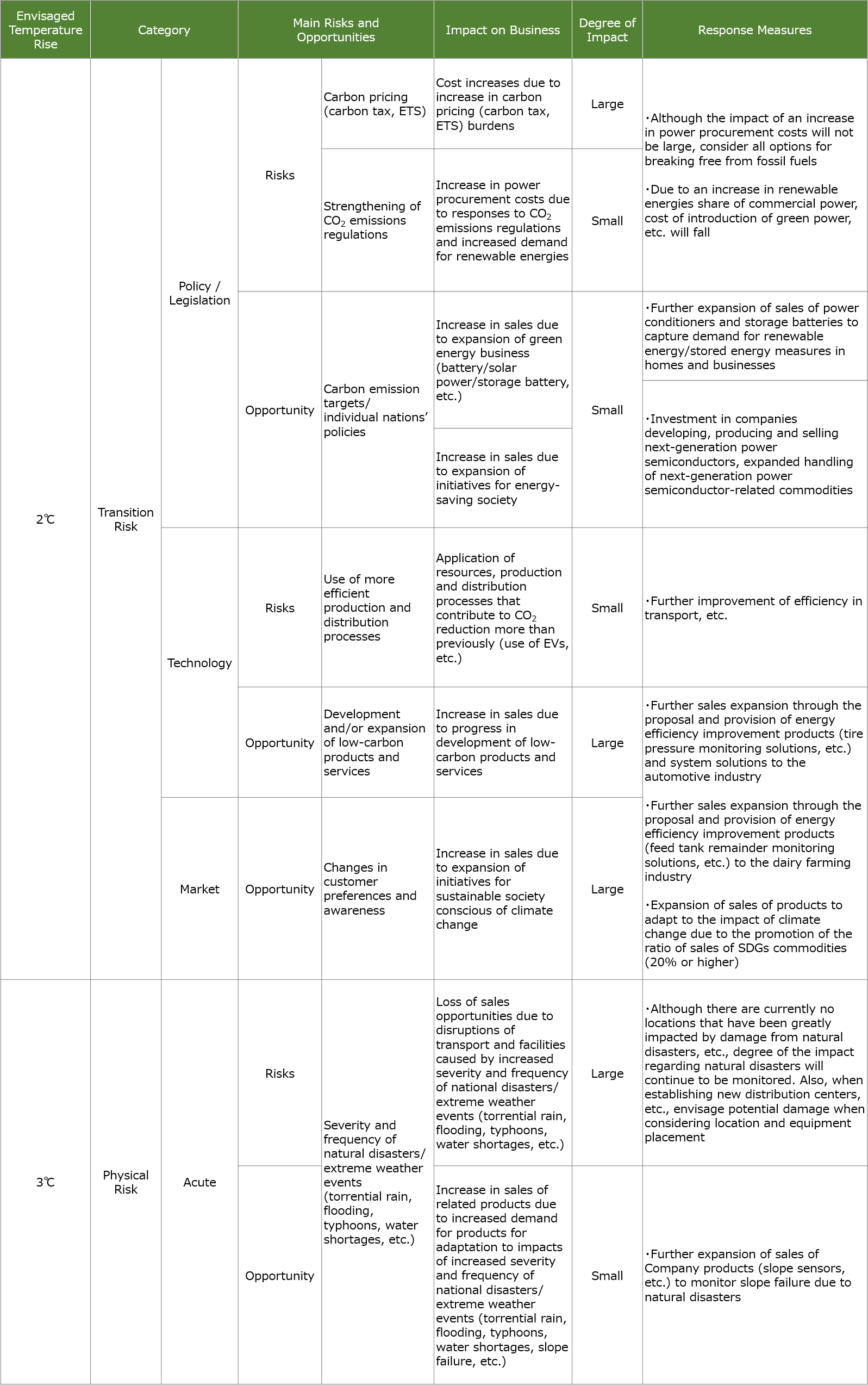

Strategies

Based on the TCFD Recommendations, pursuant to the SDS*1 of the International Energy Agency (IEA) and the NDCs*2 scenario, the Company conducted scenario analyses for Japan of the impact (transition risks and opportunities) of policy and market trend transitions and of physical changes (physical risks and opportunities) such as disasters. It then considered the impact on the Company’s business of the identified risks and opportunities and responses measures toward them. Recognizing that the mitigation of climate change risk is essential to contributing to the realization of a sustainable society and achieving the Company’s sustainable growth, the Company will evaluate the financial impacts of each scenario, proceed with scenario analyses for overseas, and reflect their results in management planning. In the future, the Company will aim toward the 1.5℃ scenario.

*1 SDS: Sustainable Development Scenario. A scenario formulated by IEA in which global temperature rise is confined to around 2℃ higher than pre-industrial levels.

*2 NDCs: Nationally Determined Contributions. A scenario in which the greenhouse gas emissions reductions pledged by each country in the Paris Agreement is achieved.

Results of Scenario Analyses

Indicators and Targets

・FY2019, the year that the Company began calculating its CO₂ emissions, has been chosen as the base year for CO₂ emissions.

・ For current CO₂ emissions, only emissions from domestic electricity and gasoline use are counted in calculations.

* The scope of calculation will be progressively expanded.

2. CO₂ emissions reduction targets

The Company’s Scope 1 & 2 CO₂ emissions in FY2019 were 952 t-CO₂. In addition to a long-term target of net zero CO₂ emissions by FY2050, the Company will set a CO₂ emissions reduction target for FY2030 and will pursue CO₂ emissions reduction initiatives in its business activities. Going forward, the Company will review its short- and medium-term CO₂ emissions targets to achieve its targets sooner.

| FY2019 Result | FY2020 Result | FY2021 Result | FY2022 Result | FY2030 Target (compared with FY2019) |

|

|---|---|---|---|---|---|

| Scope 1&2 | 952 | 951 | 723 | 742 | 470 (50% reduction ▲480) |